Big Tech For Small Banks

Net Interest Margin Fee Income Safety and Soundness

FEW WORDS ABOUT US

About Amberoon

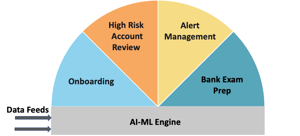

Amberoon addresses C-suite priorities with solutions that improve Net Interest Margin (NIM), boost fee income, and effectively manage risk within the safety and soundness mandates of community banks. Amberoon solutions bring big tech to small banks—tools typically beyond the reach of smaller institutions. Amberoon products leverage advanced technologies like GenAI tailored for banking workflows, secure identity management using blockchain, and predictive models using machine learning to solve business problems that add immediate value for banks. As an approved vendor for many banks and the U.S. Treasury, we offer regulator-inspired solutions that improve efficiency and effectiveness of community banks.

Dawn Dauer

Chief Banking Officer, The Bank of Missouri

Chris Nichols

Director of Capital Markets, South State Bank

Robb Gaynor

Sr Publisher of Searching For AI

SAAS PRODUCT

Solutions

ELITE FEATURES

Agile Approach

SAAS PRODUCT

Agile Analytics Blog

Source: “When Community Banks Get the Credit: A Statum KPI Credit Card Rate Cap Impact Analysis | January 26, 2026” So there was JPMorgan ...

Here is a funny AI story. San Francisco. A quiet night in 2024. A parking lot near 2nd Street and Harrison. Residents nearby heard an odd ...

Every community bank CEO now faces unprecedented challenges. At the same time, powerful new capabilities—Artificial Intelligence (AI) in ...

On May 13, 2025, the U.S. government announced a significant easing of long-standing economic sanctions on Syria, authorizing expanded ...

In our continuing exploration of banking technology that truly matters, the emergence of Absolute Zero Reasoner (AZR) demands attention as ...

When Acting Chairman Travis Hill unveiled his January 2025 agenda, it highlighted a well-known issue: small banks are struggling with the ...

SAAS PRODUCT

Press Release

Unique findings from comprehensive analysis of 87,046 forecasts across 4,412 banks Cupertino, Calif. – October 22, 2025 – Community bank ...

Privacy-first technology eliminates forced choice between customer experience and compliance for community banks Cupertino, Calif. – ...

SAAS PRODUCT

news

It still runs many large banks around the globe so what can be done about DXC’s mainframe-based workhorse, Hogan? The supplier has a plan and ANZ is one of those on the journey

WASHINGTON – The Federal Deposit Insurance Corporation (FDIC) today announced the selection of six teams to participate in a ‘tech sprint’ designed to explore new technologies and techniques to determine how well community banks, and the banking sector as a whole, can withstand a major disruption of any type.

Technology firms that will make up six teams were selected to participate in a “tech sprint” designed to explore new technologies and techniques to determine how well community banks, and all banks, can withstand a major disruption of any type, the federal insurer of bank deposits said Monda

Last year, IBM designed an industry-first platform called the IBM Cloud for Financial Services™. This summer we introduced a partner ecosystem to support the platform.

Our partners create consistent reliable services and more personalized experiences every day on the IBM Cloud. We asked partners why they chose the IBM Cloud for Financial Services. Here’s what they had to say.

Banks today are facing a significant challenge: they must evolve to follow the latest trends in new technology and consumer demand, while adhering to stricter and ever-changing industry regulations.

The Federal Deposit Insurance Corporation (FDIC) today announced the selection of 14 technology companies to compete in the next phase of the agency’s Rapid Prototyping Competition, a tech sprint designed to develop an innovative new approach to financial reporting, particularly for community banks.

%20(1)%20(1).png)

.png)