The Amberoon Advantage

Amberoon focuses exclusively on the top priorities of Boards of Directors and C-suite executives at community banks: Net Interest Margin, Fee Income, and Compliance. Our approach to Big Tech development is guided by a singular philosophy: "BankTone," intuitive and integrated solutions as familiar as a dial tone.

SAAS PRODUCT

Customer Voices

Andrew Drake

Founder and CEO, Bellecour Insurance

Dawn Dauer

Chief Banking Officer, The Bank of Missouri

Chris Nichols

Director of Capital Markets, South State Bank

Robb Gaynor

Sr Publisher of Searching For AI

The Technology Suite

Amberoon offers a portfolio of interconnected solutions that leverage advanced technologies such as AI, blockchain, analytics and encryption, all tailored for banking priorities

Manatoko ID

Advanced Identity Management

Manatoko KYC (Know Your Customer), Manatoko BOIR (Beneficial Ownership Information Reporting), Manatoko VC (Verifiable Credentials) and Manatoko Dossier. Manatoko, the foundation for identity verification, dynamic risk assessment and data privacy

Link text

Statum KPI

Performance Management and Analytics

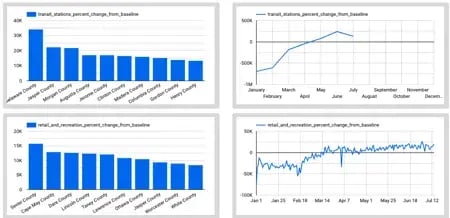

This NIM and Fee Income powerhouse helps manage a bank’s performance against its peers, with psychographic analysis of customer personas to provide predictive insights into market sentiment to guide business strategy and reduces attrition risk.

Link text

Lucre AML

Modernized Risk and Compliance

This solution goes far beyond static monitoring to power persona management, pinpointing bad actors through their behaviors, networks, digital footprints and more. This makes the detection of financial crimes dramatically more effective

Link text

Vento

Revenue Acceleration

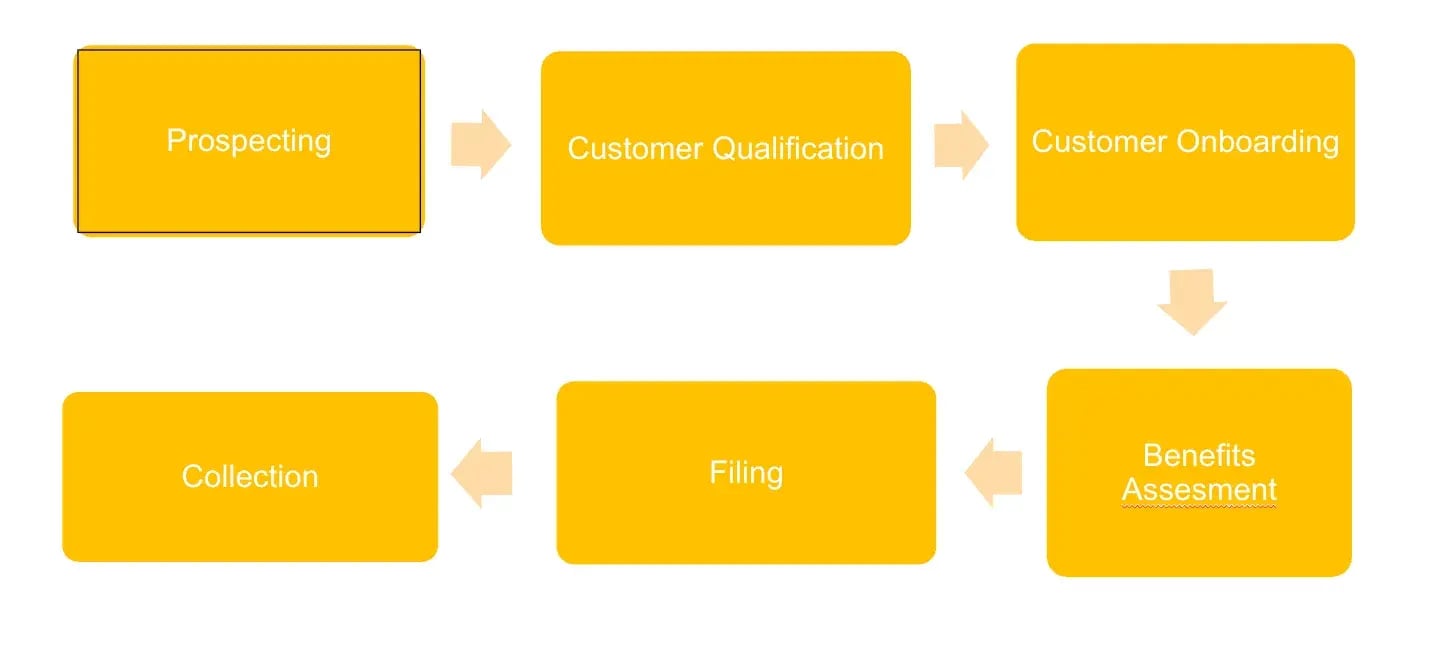

Vento Kredit leverages sophisticated workflows and systematic insights to maximize revenue generation in benefits programs, incentive management, and customer engagement initiatives. It balances efficient operations, an enhanced customer experience and sustainable fee income

Link textThe Business Value

Dual Solutions

Management at small banks serve two bosses: Shareholders who want to optimize Net Interest Margin and Fee Income, and Regulators with compliance mandates that drain resources

Amberoon solves both these challenges

The BankTone Standard

Unlike bank tech solutions that require big budgets, Amberoon pioneers BankTone: sophisticated platforms deliver just what the C-suite needs, with the simplicity and familiarity of a dialtone

Enterprise-grade technology without enterprise-level complexity

Proven Credibility

An approved vendor for banks and the U.S. Treasury, SOC 2 certification, deep relationships with regulators—Amberoon has prototyped technologies for the FDIC

Sample results: 85% drop in false positives, measurable NIM gains, streamlined compliance

Integrated Ecosystem

Amberoon's core platforms are perfectly integrated and aligned with C-suite priorities—a comprehensive portfolio to address identity management, performance analytics, compliance, and revenue generation

This is true Silicon Valley innovation—productivity without complexity

SAAS PRODUCT

Agile Analytics Blog

Source: “When Community Banks Get the Credit: A Statum KPI Credit Card Rate Cap Impact Analysis | January 26, 2026” So there was JPMorgan ...

Here is a funny AI story. San Francisco. A quiet night in 2024. A parking lot near 2nd Street and Harrison. Residents nearby heard an odd ...

Every community bank CEO now faces unprecedented challenges. At the same time, powerful new capabilities—Artificial Intelligence (AI) in ...

On May 13, 2025, the U.S. government announced a significant easing of long-standing economic sanctions on Syria, authorizing expanded ...

In our continuing exploration of banking technology that truly matters, the emergence of Absolute Zero Reasoner (AZR) demands attention as ...

When Acting Chairman Travis Hill unveiled his January 2025 agenda, it highlighted a well-known issue: small banks are struggling with the ...

SAAS PRODUCT

Press Release

Unique findings from comprehensive analysis of 87,046 forecasts across 4,412 banks Cupertino, Calif. – October 22, 2025 – Community bank ...

Privacy-first technology eliminates forced choice between customer experience and compliance for community banks Cupertino, Calif. – ...

SAAS PRODUCT

news

It still runs many large banks around the globe so what can be done about DXC’s mainframe-based workhorse, Hogan? The supplier has a plan and ANZ is one of those on the journey

WASHINGTON – The Federal Deposit Insurance Corporation (FDIC) today announced the selection of six teams to participate in a ‘tech sprint’ designed to explore new technologies and techniques to determine how well community banks, and the banking sector as a whole, can withstand a major disruption of any type.

Technology firms that will make up six teams were selected to participate in a “tech sprint” designed to explore new technologies and techniques to determine how well community banks, and all banks, can withstand a major disruption of any type, the federal insurer of bank deposits said Monda

Last year, IBM designed an industry-first platform called the IBM Cloud for Financial Services™. This summer we introduced a partner ecosystem to support the platform.

Our partners create consistent reliable services and more personalized experiences every day on the IBM Cloud. We asked partners why they chose the IBM Cloud for Financial Services. Here’s what they had to say.

Banks today are facing a significant challenge: they must evolve to follow the latest trends in new technology and consumer demand, while adhering to stricter and ever-changing industry regulations.

The Federal Deposit Insurance Corporation (FDIC) today announced the selection of 14 technology companies to compete in the next phase of the agency’s Rapid Prototyping Competition, a tech sprint designed to develop an innovative new approach to financial reporting, particularly for community banks.

Social Media

Call to Action

Ready to experience BankTone for your institution?

Contact us today to discover how community banks are leveraging Big Tech without big complexity.