Amberoon Lucre AML

Monitor, measure,manage and Mitigate AML Risk

Modern AML

Amberoon’s Lucre is a modernized Anti-Money Laundering (AML) solution that uses Agile Compliance to closely align with a bank’s mandate of safety and soundness. Amberoon leverages advances in AI, data engineering and security to make complex AML processes insightful, efficient and cost-effective—without requiring costly replacements to legacy technologies. Unlike traditional approaches, Lucre allows governance and process to drive the technology and not the other way around. Core functions include.

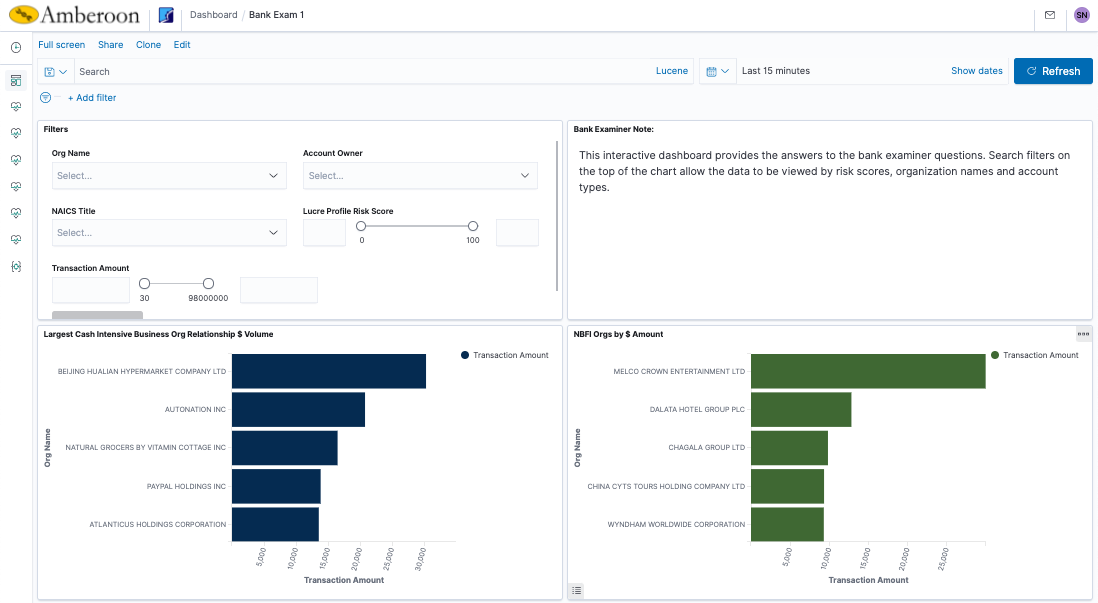

- + Bank Exam Prep

- + Monitoring of High Risk

- + Alert Management

- + On-boarding

Smart Risk Triage

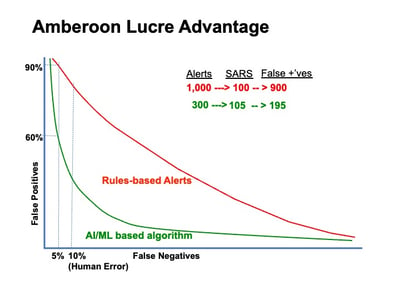

Amberoon Lucre AML uses data from ongoing transactions, third-party sources and proprietary algorithms to enable forensic inquiry that identifies bad actors and reduces risk. The technology builds on a risk-based approach that works with legacy AML systems to implement a Regulatory System of Insight for banking operations.

Core Capabilities

And again, there’s no need to replace existing systems: Amberoon AML has ‘wraparound’ capabilities to work with legacy solutions in mid-contract.

-

Significantly reduces false positives

-

Slashes operating costs by up to 50%

-

Eases behavioral KYC

-

Identifies emerging risks

-

Accelerates UBO (Ultimate Business Owner) tracking.