SVB - Deconstructing the Day the music died

It was more than half a century ago that Don McLean released American Pie, and it’s served as an anthem to successive generations. It’s a paean to the day the music died, and so filled with references that the trivia questions never stop. Sure, we know the direct events that inspired it—three rock and roll pioneers and their pilot dying in a plane crash—but there are also endless clues, messages and lyrical strands that we want to decipher and decode.

February made me shiver…

This may sound a little fanciful, but to some of us who have spent years at the intersection of technology and finance, a very different kind of crash that occurred recently on March 9 may become a similar milestone. This is the fall of Silicon Valley Bank, and sure, we know the basics of what happened. But throughout this tale there were signs and signals that could and should have been detected.

But were they? Regulators rate banks according to the CAMELS standard: Capital Adequacy, Assets, Management, Earnings, Liquidity and Sensitivity. It’s a scale of 1-5—banks at the low end, 1-2, are considered low risk, while those scoring a 5 are very high risk. CAMELS ratings are strictly confidential, so we don’t (yet) know how SVB was rated.

Here at Amberoon, we find those red flags. Amberoon Statum KPI offers a peek into the future: It helps financial services institutions directly measure and manage their performance against selected peer groups, with forecasts based on decades of historical data. Statum KPI analyzes 8,000 data points in reports from nearly 5,000 banks every quarter, and leverages advances in AI, data engineering and analytics to create a Regulatory System of Insight that supports key operational decisions. The technology has a serious pedigree: Statum KPI is based on a prototype Amberoon built for the FDIC in the early days of the pandemic (remember the fears of a run on the banks back then?).

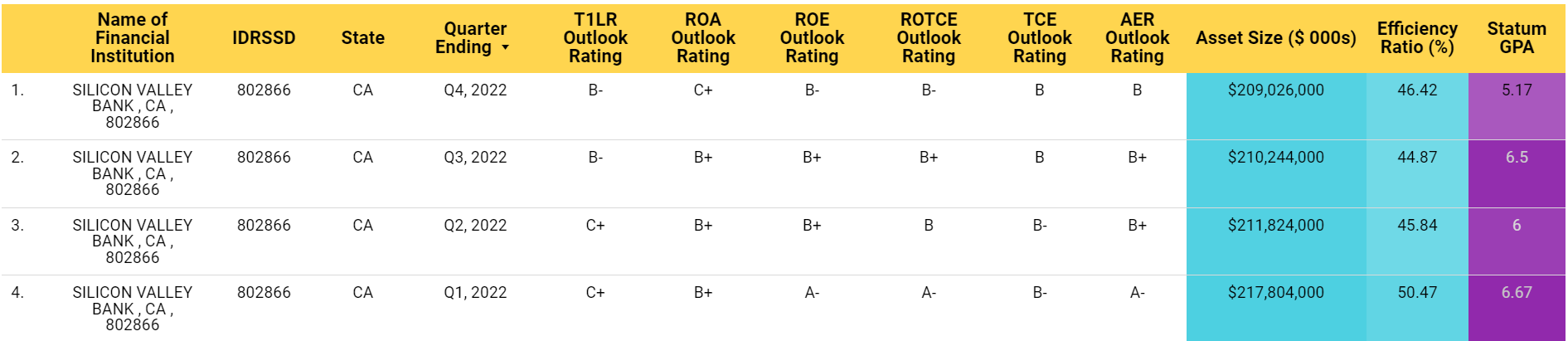

With all this data and a predictive model powered by machine learning, we rate banks’ outlook every February, April, August and October. Here’s a taste of what we found at SVB in February.

We all know there was a run on the bank when it announced a raise of $2B to offset losses from selling securities. But there was a lot more going on before the calamity became public.

First, like some tech startups, SVB had a growth spurt during the pandemic: from $74B in assets in Q1 2020 to $209B in Q4 2022. That took it from 38th place nationally to 17th, an unusual spike among banks bound by a regulatory mandate of safety and soundness.

It also turns out SVB has been under enhanced scrutiny since 2021. According to The New York Times, Federal Reserve had given it six citations related to management of liquidity risk. In early 2023, it was under “horizontal review,” which identified additional deficiencies in risk management. And all this while it was growing incredibly fast.

We’re not privy to the discussions between the bank and its regulators, but we do have access to public data. And with our tools, that’s a goldmine.

Here’s Amberoon’s rating for all four quarters in 2022: SVB’s outlook declined consistently on several key performance indicators. These grades are relative ratings compared to nearly 5,000 US banks. The 9-point scale has A+ with 10 points and C- with 2 points. Statum GPA is an average that can be used to rank banks based on outlook. SVB GPA went from 6.67 in Q1 to 5.17 in Q4 or a drop from B+ to B-. More importantly, SVB went from being in the top third of all banks in the US to the bottom 15% based on their Statum GPA rating.

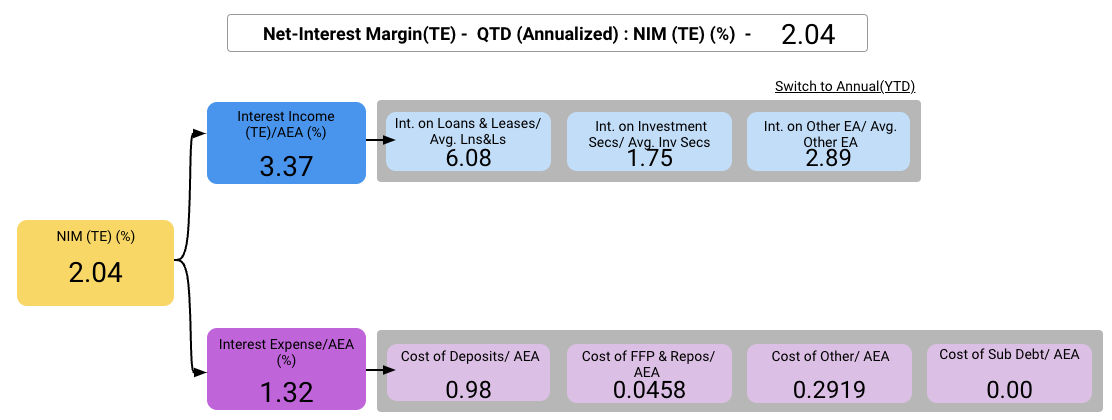

The drop in performance prompted us to look at SVB’s Net Interest Margin (NIM) and Cost to Fund Earning Assets. Here’s what we found: Silicon Valley Bank was at 2.04%, compared with an average of about 3.67% for all other banks.

The drop in performance prompted us to look at SVB’s Net Interest Margin (NIM) and Cost to Fund Earning Assets. Here’s what we found: Silicon Valley Bank was at 2.04%, compared with an average of about 3.67% for all other banks.

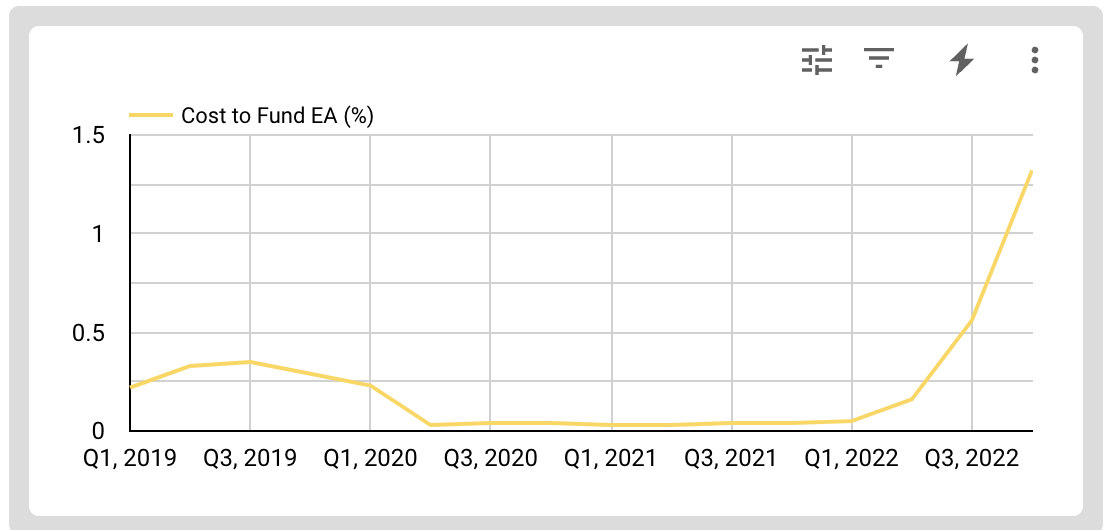

The high cost of funds is a definite warning sign, and it helps to compare SVB to other banks. What is more disturbing is the increase in the Cost to Fund Earning Assets (COFEA) over time which is shown in this graph. SVB's COFEA doubled from 0.7% to 1.32% from Q3 to Q4 2022.

All banks had issues with deposits during 2022—the entire industry went from being flush with deposits in Q1 to scrambling for them in Q4. As a result, most institutions experienced some increase in the Cost to Fund Earning Assets. However SVB's problems were worse than others -SVB's Cost to Fund to Earning Assets was the highest among their peer banks in California.

All banks had issues with deposits during 2022—the entire industry went from being flush with deposits in Q1 to scrambling for them in Q4. As a result, most institutions experienced some increase in the Cost to Fund Earning Assets. However SVB's problems were worse than others -SVB's Cost to Fund to Earning Assets was the highest among their peer banks in California.

So, here’s our top line view of SVB before the crash:

Performance: This was on a decline based on key metrics such as ROA/ROE/ROTCE, widely accepted measures of bank performance. SVB’s GPA reflects its outlook on performance. The C+ on ROA in Q2 was particularly noteworthy.

Net Interest Margin: This is simply defined as the interest for loaning money minus the cost of funds. A consistently low NIM compared to others in the peer group is a bad omen for any bank. SVB was in the bottom third of its peer group in 2022

Cost to Fund Earning Assets: This is based on total interest expense for money that comes from deposits and interest-bearing liabilities (IBL), which represents interest on US Treasury notes and other borrowed money. The IBL number went from 0.47% in Q1 to 4.45% in Q4, and this had a direct impact on Cost to Fund Earning Assets.

These factors are symptomatic of other troubles in the bank. Their are other metrics such as Capital Adequacy, Asset Quality and Liquidity that are routinely tracked by the bank and industry analysts which had similar warning signs. All of these were available in February much before the March 9 crash.

Silicon Valley Bank will forever occupy a strange place in the history of the American economy. It wasn’t the first or largest financial services institution to actively embrace technology—in fact, it was born in 1983, long before the Internet went mainstream—and it wasn’t the first to come up short in its bid to be a symbol of the digital era. However, thanks to its nature and especially its name, it represents a huge fall in the ongoing attempt to marry new technology with old-school finance.

But by the same token, we do indeed have new technology to avert those problems. Imagine the bright red flags we would have seen with a sophisticated AI-based model offering a benchmark against 10 other banks within an appropriate peer group.

Remember, the balance sheet did show $120B of investment securities. Borrowing a few billion against this collateral doesn’t sound like a stretch. Recognizing these exposures would have prompted a strategy before the fall rather than the panicked response after.

That’s why we’re raising our hand and talking about innovations like Statum KPI. The best thing about these solutions is not just the value they deliver but that those benefits are not only for the big banks. We say it’s big fintech even for smaller banks, and that’s very true: These are agile financial technologies to help monitor, manage and mitigate operational risk, and measure performance against peer institutions.

The next bank to falter won’t get as much attention as SVB but the impact will be just as devastating. Better to stay ahead of the perils and prevent looking for cryptic clues:

And while Lenin read a book on Marx

A quartet practiced in the park

And we sang dirges in the dark

The day the music died. . .

Posts by Tag

- big data (41)

- advanced analytics (38)

- business perspective solutions (30)

- predictive analytics (25)

- business insights (24)

- data analytics infrastructure (17)

- analytics (16)

- banking (15)

- fintech (15)

- regulatory compliance (15)

- risk management (15)

- regtech (13)

- machine learning (12)

- quantitative analytics (12)

- BI (11)

- big data visualization presentation (11)

- community banking (11)

- AML (10)

- social media (10)

- AML/BSA (9)

- Big Data Prescriptions (9)

- analytics as a service (9)

- banking regulation (9)

- data scientist (9)

- social media marketing (9)

- Comminity Banks (8)

- financial risk (8)

- innovation (8)

- marketing (8)

- regulation (8)

- Digital ID-Proofing (7)

- data analytics (7)

- money laundering (7)

- AI (6)

- AI led digital banking (6)

- AML/BSA/CTF (6)

- Big Data practicioner (6)

- CIO (6)

- Performance Management (6)

- agile compliance (6)

- banking performance (6)

- digital banking (6)

- visualization (6)

- AML/BSA/CFT (5)

- KYC (5)

- data-as-a-service (5)

- email marketing (5)

- industrial big data (5)

- risk manangement (5)

- self-sovereign identity (5)

- verifiable credential (5)

- Hadoop (4)

- KPI (4)

- MoSoLoCo (4)

- NoSQL (4)

- buying cycle (4)

- identity (4)

- instrumentation (4)

- manatoko (4)

- mathematical models (4)

- sales (4)

- 2015 (3)

- bitcoin (3)

- blockchain (3)

- core banking (3)

- customer analyitcs (3)

- direct marketing (3)

- model validation (3)

- risk managemen (3)

- wearable computing (3)

- zero-knowledge proof (3)

- zkp (3)

- Agile (2)

- Cloud Banking (2)

- FFIEC (2)

- Internet of Things (2)

- IoT (2)

- PPP (2)

- PreReview (2)

- SaaS (2)

- Sales 2.0 (2)

- The Cloud is the Bank (2)

- Wal-Mart (2)

- data sprawl (2)

- digital marketing (2)

- disruptive technologies (2)

- email conversions (2)

- mobile marketing (2)

- new data types (2)

- privacy (2)

- risk (2)

- virtual currency (2)

- 2014 (1)

- 2025 (1)

- 3D printing (1)

- AMLA2020 (1)

- BOI (1)

- DAAS (1)

- Do you Hadoop (1)

- FinCEN_BOI (1)

- Goldman Sachs (1)

- HealthKit (1)

- Joseph Schumpeter (1)

- Manatoko_boir (1)

- NationalPriorites (1)

- PaaS (1)

- Sand Hill IoT 50 (1)

- Spark (1)

- agentic ai (1)

- apple healthcare (1)

- beneficial_owener (1)

- bsa (1)

- cancer immunotherapy (1)

- ccpa (1)

- currency (1)

- erc (1)

- fincen (1)

- fraud (1)

- health app (1)

- healthcare analytics (1)

- modelling (1)

- occam's razor (1)

- outlook (1)

- paycheck protection (1)

- personal computer (1)

- sandbox (1)

Recent Posts

Popular Posts

Source: “When Community Banks Get the Credit: A...

Here is a funny AI story.

Every community bank CEO now faces unprecedented...