Chase CEO Says Small Businesses Will Lose Their Backup Credit. That Could be An Opportunity for Community Banks

Source: “When Community Banks Get the Credit: A Statum KPI Credit Card Rate Cap Impact Analysis | January 26, 2026”

So there was JPMorgan Chase CEO Jamie Dimon at the Davos summit earlier this month, and he was asked a simple question: What did he think of President Trump’s proposal to cap credit card interest rates at 10%? It was a reasonable query. Davos is a very important setting, Chase is a credit card giant, and this edict, if enacted, would be hugely consequential.

Dimon is normally quite reticent, but this time he let loose. He called the idea an "economic disaster" that would "remove credit from 80% of Americans." His CFO doubled down on this claim shortly after, and the industry is now experiencing uncertainty and tremors.

The warnings are dire and may even be accurate. The problem is that the loudest voices are offering opinions without the data. Also, as is often the case, the focus is almost entirely on the large money center institutions, not the 4,000+ community banks that could play a vital role in this evolving scenario.

We have the rest of the story. Amberoon analyzes bank data continuously using Statum KPI, and that's how we know there's a significant community bank perspective with major ramifications.

First, this is not a an "all banks" problem.

The 18 institutions facing severe risk from a rate cap are mainline card issuers. They built business models on high-APR revolving credit, and a 10% cap breaks their math. They will restrict credit, and millions of small businesses will feel the pain. As Dimon said, these cards are "backup credit" for consumers and small businesses alike. Take that away, and businesses miss payroll which means their employees can’t make their rent.

But (and you won't find this anywhere in the news) this is not a threat to community banks. Managed right, it’s an opportunity.

When credit card companies cut off small businesses, those firms will still need working capital. They will still need bridge financing for inventory, receivables gaps, and seasonal cash flow.

Are community banks ready to serve them?

The Data Behind the Rhetoric

We’ve done this before. We built Amberoon’s Statum KPI solution on a key principle. Measure before you opine.

At the height of the pandemic, we worked with the FDIC to predict which banks would fail under stress. That work required institution-by-institution analysis traced back to regulatory filings. Not industry talking points but genuine and defensible deductions.

We applied that same discipline to the rate cap question. “When Community Banks Get the Credit, our Credit Card Rate Cap Impact Analysis" examined 4,435 FDIC-insured banks using Q3 2025 Call Report data.

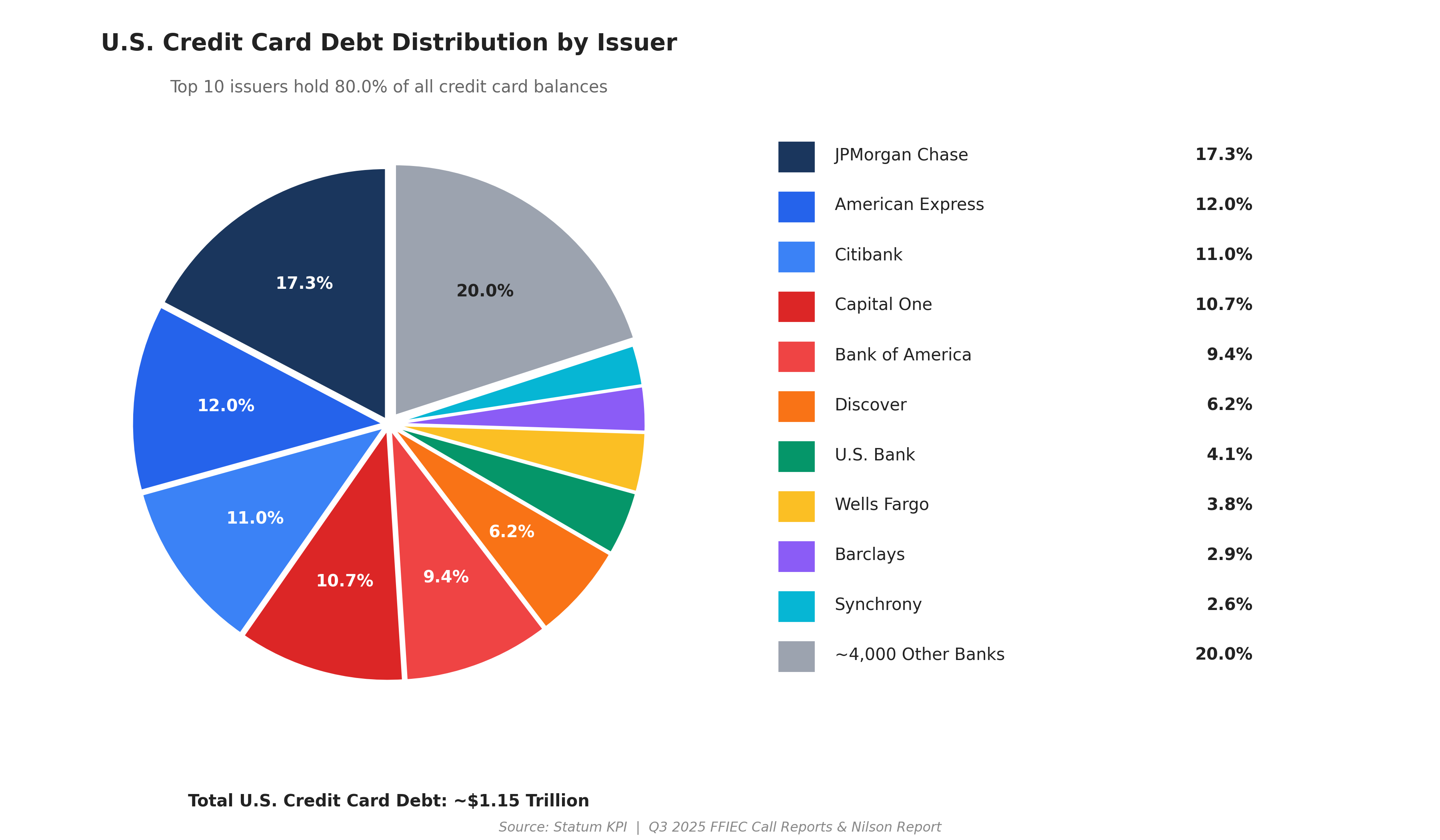

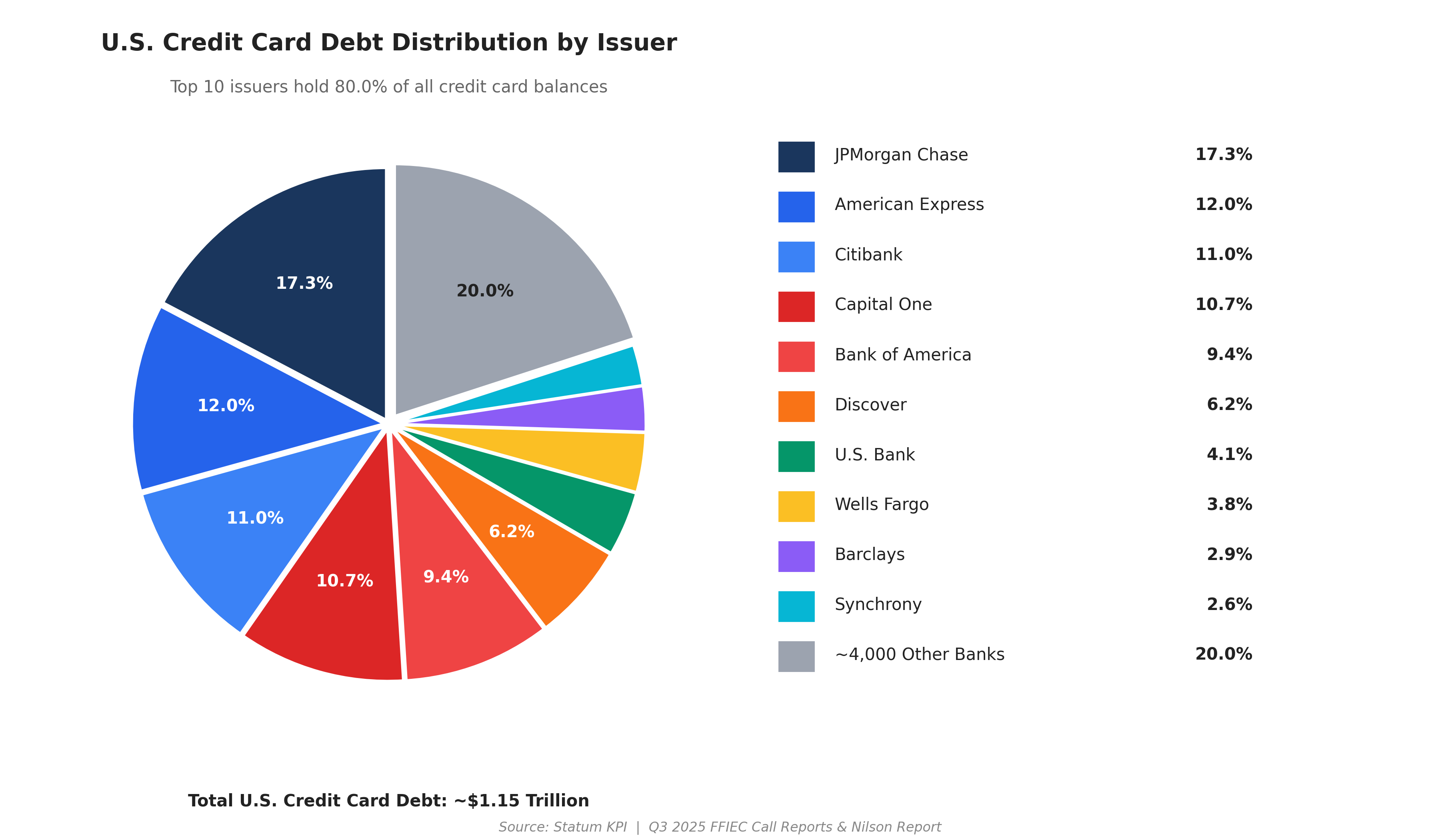

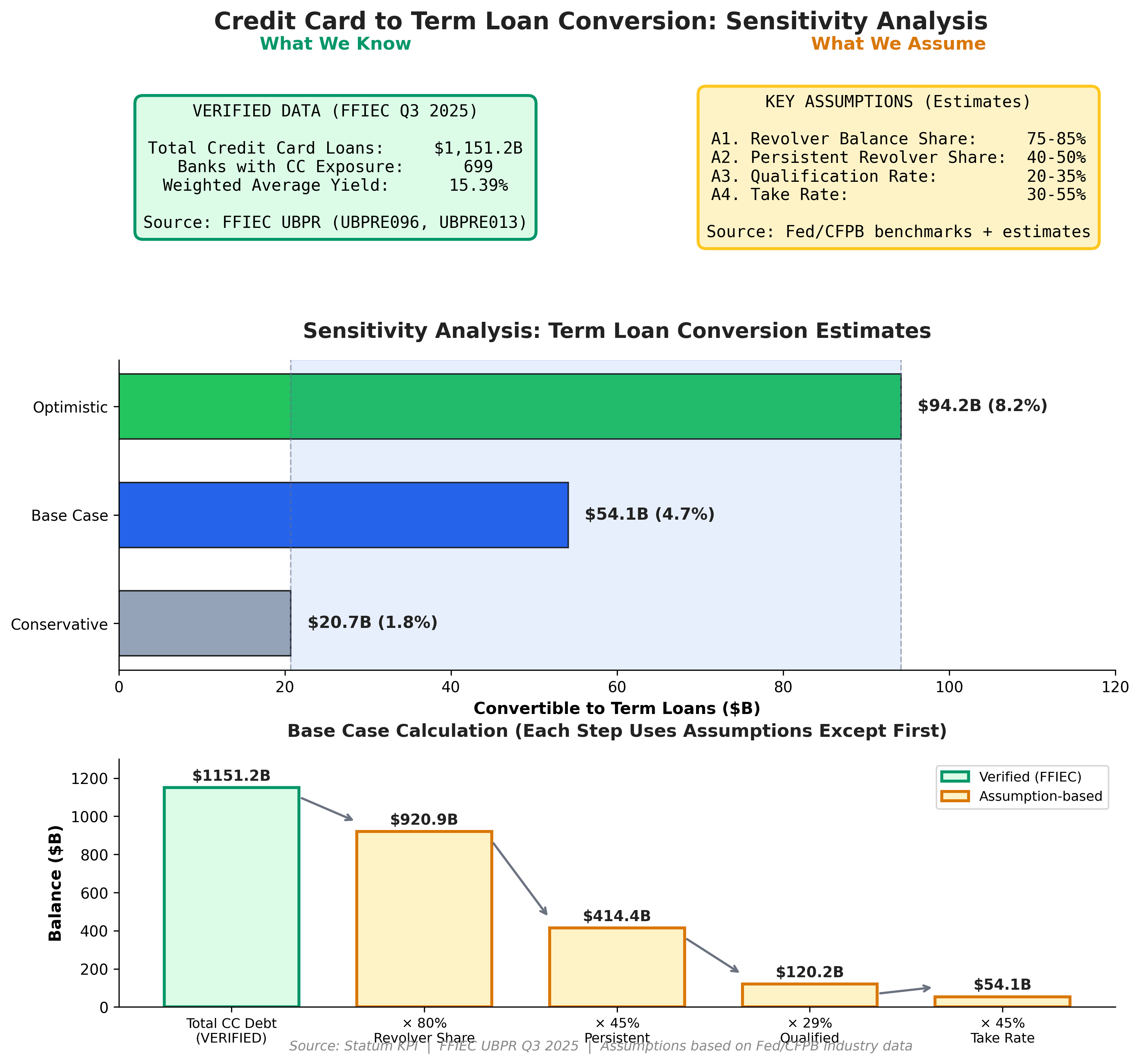

Let’s start with the biggest numbers. Only one is official:: U.S. banks hold $1.15 trillion in credit card loans. But how many cardholders carry balances? How many would qualify for a term loan? How many would actually take one?

We stress-tested the ranges. The result: Between $21 billion and $94 billion could convert to term loans under a rate cap. Our base case is $54 billion.

Now, we can report that 84.2% of U.S. banks have minimal card exposure. A rate cap does not affect them directly.

The existential crisis is concentrated in exactly 18 banks that would see their ROA fall below negative one percent under a 10% cap. These banks collectively hold $272.6 billion in credit card loans. That is 23.7% of the system total. The worst-hit would swing from modest profitability to double-digit negative ROA.

These are the institutions that will restrict credit. These are the banks whose customers will need somewhere else to turn.

The math is unforgiving. Cost of funds plus operations plus charge-offs exceeds 10% for anyone below super-prime. At 10% APR, only the safest borrowers pencil out. Everyone else gets cut.

The American Bankers Association projects that the majority of open credit card accounts would be closed or drastically reduced. That affects over a hundred million consumers and the small businesses that depend on revolving credit for daily operations.

Dimon warned that "the people crying the most won't be the credit card companies, it will be the restaurants, the retailers, the travel companies."

He is describing community bank customers. The dry cleaner who floats inventory on a business card. The contractor who bridges receivables gaps. The restaurant owner who covers payroll during slow weeks.

These businesses need better credit, not the 21% APR they are often saddled with. Some might not qualify for the lower rates, but some will.

Why This Is An Opportunity

Traditional community banks do not issue credit cards at scale. They never have. Their business is relationship lending. Commercial real estate. Small business lines. Agricultural loans. Residential mortgages.

That is precisely why the rate cap creates opportunity rather than threat.

The 699 banks in our "Not Critical" tier would remain profitable under even a 10% cap. Their average ROA impact is minimal, statistical noise.

But those same banks hold the infrastructure, the relationships, and the underwriting capabilities to serve small businesses that are about to lose their backup credit. The question is not whether community banks will survive the rate cap. The question is whether they are positioned to capture the demand it creates.

Here’s our message to community banks around the nation: You know your borrowers. As an ag lender, you know the inner workings of every farm in three counties. As a local business banker, you know every entrepreneur in town. Relationship lending means you can underwrite based on character, cash flow, and context, not just FICO scores.

A small business does not need a 21% revolving line. It needs a $50,000 operating line at 8% tied to receivables. It needs seasonal credit facilities that match actual cash flow patterns. It needs someone who picks up the phone.

You are already compliant. Community banks operate under the same regulatory framework they always have. No charter arbitrage. No "rent-a-bank" complexity. When the rate cap hits, you are not restructuring your business model. You are expanding your market.

A Focus On Strategy

If you are a community bank CEO, the rate cap debate should not be about survival. It should be about strategy.

First, quantify your direct exposure. Our analysis shows 84% of banks have none. If you are in that majority, stop worrying about the threat and start planning for the opportunity.

Second, assess your small business lending capacity. When credit card companies restrict access, demand for traditional lines of credit will increase. Do you have the underwriting infrastructure to serve it? The lending authority? The products?

Third, identify the customers you should be targeting. Which local businesses currently rely on credit cards for working capital? Which ones are relationship prospects you have been meaning to pursue? The rate cap may accelerate their need to find alternatives.

Fourth, prepare your messaging. Small business owners are going to hear that credit is disappearing. They need to hear that their community bank is ready to serve them. This is a moment for proactive outreach, not reactive damage control.

Wall Street is panicking because that business model is under attack. Dimon is right that small businesses will lose backup credit from card issuers. He is right that this will cause pain.

But community banks are not card issuers. They are relationship lenders.

When credit gets restricted, some of those small businesses will need new sources of working capital. The restaurants, retailers, and contractors Dimon is worried about will need someone to pick up the phone and structure a line of credit that actually fits their business.

That is not a threat to community banks. That is the opportunity.

“When Community Banks Get the Credit: A Statum KPI Credit Card Rate Cap Impact Analysis | Q3 2025” FFIEC Data | January 26, 2026 provides bank-by-bank rankings, interactive cohort analysis, and complete methodology documentation. Send an email to Statum@amberoon.com for a free copy of the report.

Posts by Tag

- big data (41)

- advanced analytics (38)

- business perspective solutions (30)

- predictive analytics (25)

- business insights (24)

- data analytics infrastructure (17)

- analytics (16)

- banking (15)

- fintech (15)

- regulatory compliance (15)

- risk management (15)

- regtech (13)

- machine learning (12)

- quantitative analytics (12)

- BI (11)

- big data visualization presentation (11)

- community banking (11)

- AML (10)

- social media (10)

- AML/BSA (9)

- Big Data Prescriptions (9)

- analytics as a service (9)

- banking regulation (9)

- data scientist (9)

- social media marketing (9)

- Comminity Banks (8)

- financial risk (8)

- innovation (8)

- marketing (8)

- regulation (8)

- Digital ID-Proofing (7)

- data analytics (7)

- money laundering (7)

- AI (6)

- AI led digital banking (6)

- AML/BSA/CTF (6)

- Big Data practicioner (6)

- CIO (6)

- Performance Management (6)

- agile compliance (6)

- banking performance (6)

- digital banking (6)

- visualization (6)

- AML/BSA/CFT (5)

- KYC (5)

- data-as-a-service (5)

- email marketing (5)

- industrial big data (5)

- risk manangement (5)

- self-sovereign identity (5)

- verifiable credential (5)

- Hadoop (4)

- KPI (4)

- MoSoLoCo (4)

- NoSQL (4)

- buying cycle (4)

- identity (4)

- instrumentation (4)

- manatoko (4)

- mathematical models (4)

- sales (4)

- 2015 (3)

- bitcoin (3)

- blockchain (3)

- core banking (3)

- customer analyitcs (3)

- direct marketing (3)

- model validation (3)

- risk managemen (3)

- wearable computing (3)

- zero-knowledge proof (3)

- zkp (3)

- Agile (2)

- Cloud Banking (2)

- FFIEC (2)

- Internet of Things (2)

- IoT (2)

- PPP (2)

- PreReview (2)

- SaaS (2)

- Sales 2.0 (2)

- The Cloud is the Bank (2)

- Wal-Mart (2)

- data sprawl (2)

- digital marketing (2)

- disruptive technologies (2)

- email conversions (2)

- mobile marketing (2)

- new data types (2)

- privacy (2)

- risk (2)

- virtual currency (2)

- 2014 (1)

- 2025 (1)

- 3D printing (1)

- AMLA2020 (1)

- BOI (1)

- DAAS (1)

- Do you Hadoop (1)

- FinCEN_BOI (1)

- Goldman Sachs (1)

- HealthKit (1)

- Joseph Schumpeter (1)

- Manatoko_boir (1)

- NationalPriorites (1)

- PaaS (1)

- Sand Hill IoT 50 (1)

- Spark (1)

- agentic ai (1)

- apple healthcare (1)

- beneficial_owener (1)

- bsa (1)

- cancer immunotherapy (1)

- ccpa (1)

- currency (1)

- erc (1)

- fincen (1)

- fraud (1)

- health app (1)

- healthcare analytics (1)

- modelling (1)

- occam's razor (1)

- outlook (1)

- paycheck protection (1)

- personal computer (1)

- sandbox (1)

Recent Posts

Popular Posts

Source: “When Community Banks Get the Credit: A...

Here is a funny AI story.

Every community bank CEO now faces unprecedented...