Agile Compliance

Governance drives Process. Process drivesTechnology.

What is Agile Compliance?

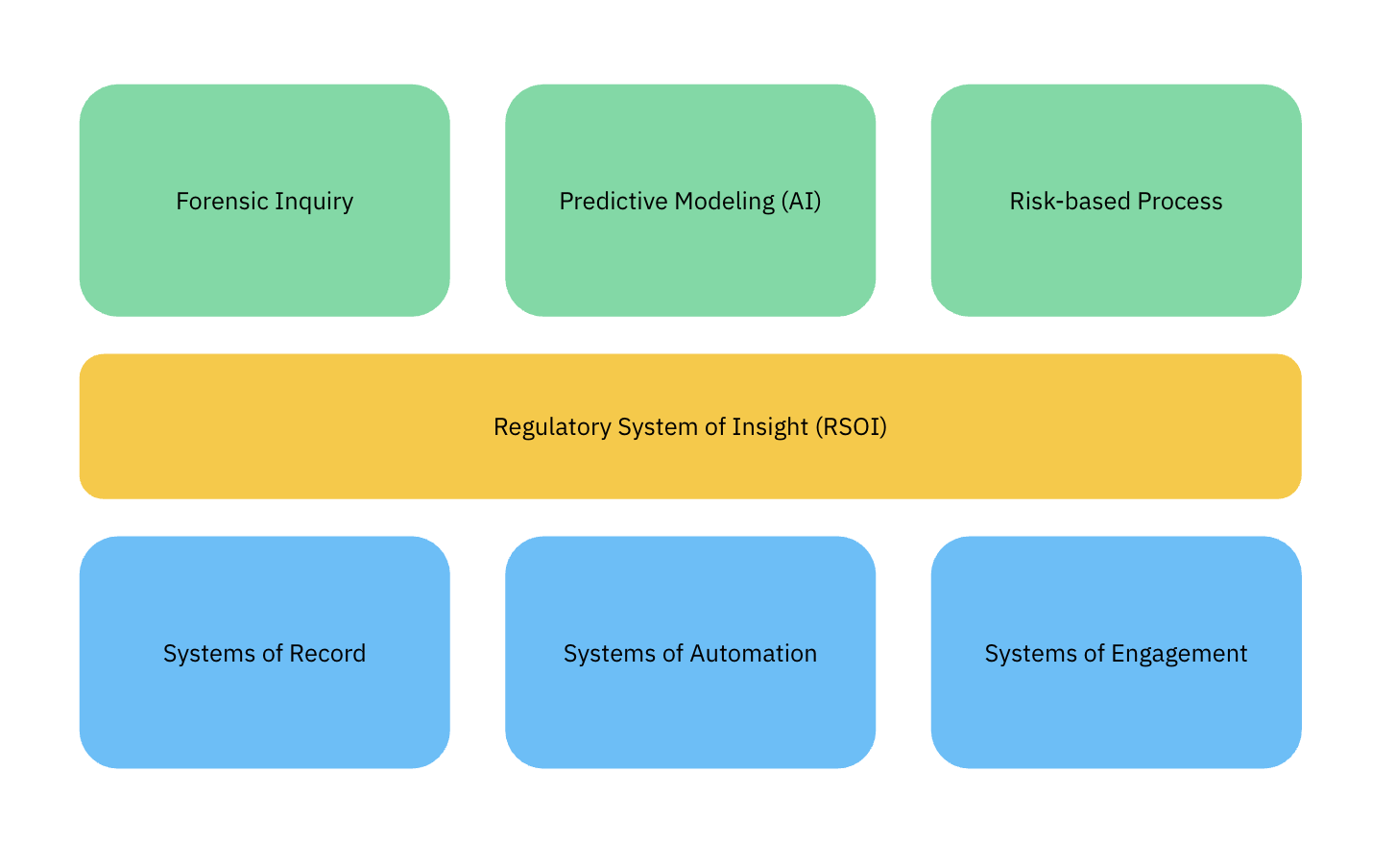

Agile Compliance is a unique approach to AML which focuses on deploying effective processes enabled by modern technology. Agile Compliance leverages the optimal combination of modern technologies and targeted processes—in this case, to take on the challenges of AML/BSA. It helps streamline processes, enhance efficiencies and ensure compliance.

Amberoon’s Agile Compliance approach is closely aligned with regulatory guidelines that require financial institutions to identify risks related to specific products, services, customers, entities and geographic locations specific. It enables banks to harness innovation while adopting best practices related to Safety & Soundness. The goal is to streamline processes, enhance efficiencies and ensure compliance. In fact, the optimal Agile Compliance approach enhances the ability to deliver regulatory projects on time.

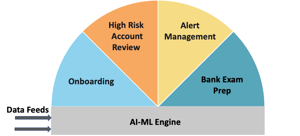

SAAS PRODUCT

Agile RSOI solutions

Banks run on data, and insights derived from that data. A lack of insight into relevant operations prevents a bank from executing on its mandate of safety and soundness. Operational risks from financial crimes are particularly serious, even an existential threat.

The best defense comes from the right blend of technology, governance and processes, but there’s a problem here: A lack of flexibility and customization means that most processes and governance priorities are limited by the technology. In fact, they’re driven by the technology.

%20(1)%20(1).png?width=300&height=145&name=Screenshot%202024-09-24%20at%208.40.56%20AM%20(1)%20(1)%20(1).png)