Amberoon Regulatory Systems of Insight (RSOI) Solutions

In this global economy, preventing money laundering is complex and critical. Any lapse exposes banks to massive risks and steep fines for non-compliance. Many current technologies don’t help much: 90% of all alerts are false positives, yet still require scrutiny.

Similarly, tracking market performance against peer institutions is a vital metric. Available solutions offer meaningless comparisons, and can even undermine necessary business strategies with irrelevant statistics.

Amberoon RSOI solutions are specifically designed to meet these vital needs. Amberoon builds on data visualization, advanced analytics, predictive modeling, machine learning and intelligent automation to deliver technologies for easy use by business, security, IT, legal and compliance professionals.

Amberoon Solutions are based on a Regulatory System of Insight (RSOI) that delivers an agile, risk-based compliance process designed for the anti-money laundering needs for banks and financial institutions.

Amberoon Lucre is a modern Anti-Money Laundering (AML) solution that uses Agile Compliance to ensure full alignment with every bank’s mandate of safety and soundness. Lucre leverages advances in AI, data engineering and security to make complex AML processes insightful, efficient and cost-effective—all without requiring costly replacements to legacy technologies. Unlike traditional approaches, Lucre allows governance and process to drive the technology, not the other way around.

Amberoon Lucre is a modern Anti-Money Laundering (AML) solution that uses Agile Compliance to ensure full alignment with every bank’s mandate of safety and soundness. Lucre leverages advances in AI, data engineering and security to make complex AML processes insightful, efficient and cost-effective—all without requiring costly replacements to legacy technologies. Unlike traditional approaches, Lucre allows governance and process to drive the technology, not the other way around.

Key benefits include:

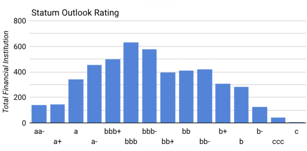

Amberoon Statum is a performance management solution that helps banks directly measure and manage their performance against peer banks. Unlike traditional operational analytics systems, Statum provides sharp insights into the future through rigorous analysis of performance patterns across multiple financial services institutions. Statum leverages advances in AI, data engineering and security to create a System of Insight to support key operational decisions.

Amberoon Statum is a performance management solution that helps banks directly measure and manage their performance against peer banks. Unlike traditional operational analytics systems, Statum provides sharp insights into the future through rigorous analysis of performance patterns across multiple financial services institutions. Statum leverages advances in AI, data engineering and security to create a System of Insight to support key operational decisions.

Key benefits include:

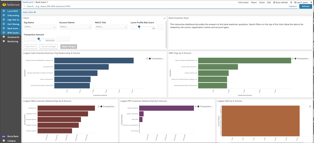

Amberoon Agile BSA Officer is a bank simulator that gives compliance teams an immersive exposure to Agile Compliance. It simulates the operations of a bank with synthetic data on over 22 thousand accounts and $12 billion in transactions.

Agile BSA Officer can be used to prototype an Agile Compliance process that can improve the effectiveness and outcomes of AML compliance operations.

Agile BSA Officer can be used to prototype an Agile Compliance process that can improve the effectiveness and outcomes of AML compliance operations.

Agile BSA Officer is powered by Amberoon Lucre.

Agile BSA Officer gives management and compliance teams instant exposure to modern technology.

19925 Stevens Creek Boulevard

#100 Cupertino, CA 95014

(408) 689-2846

© 2020 www.amberoon.com