IRS Faces a Kobayashi Maru Situation: Technology Has an answer

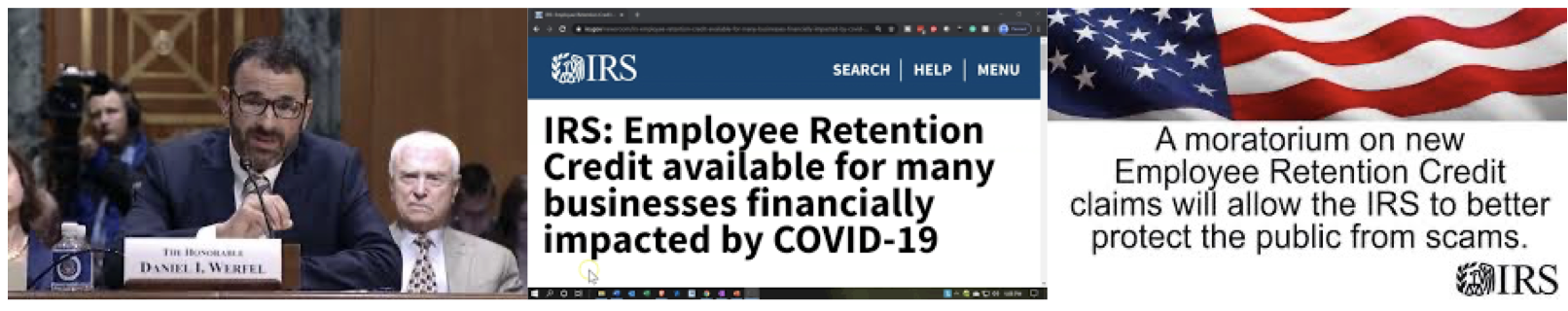

The Internal Revenue Service (IRS) is facing a real-life Kobayashi Maru, a catch-22 situation from Star Trek where there seems to be no way out. Tasked with the immense responsibility of distributing funds to pandemic-affected businesses through the Employee Retention Credit (ERC) program, the IRS is also burdened with the challenge of weeding out fraudulent claims. And to make matters worse, every delay costs them dearly, as they are obligated to pay interest on overdue refunds. It's like trying to defuse a ticking time bomb while juggling flaming torches. However, there is hope in the form of modern technology—machine learning, big data analytics, and secure ID proofing—which offers a timely solution to identify scams and expedite valid claims.

The Internal Revenue Service (IRS) is facing a real-life Kobayashi Maru, a catch-22 situation from Star Trek where there seems to be no way out. Tasked with the immense responsibility of distributing funds to pandemic-affected businesses through the Employee Retention Credit (ERC) program, the IRS is also burdened with the challenge of weeding out fraudulent claims. And to make matters worse, every delay costs them dearly, as they are obligated to pay interest on overdue refunds. It's like trying to defuse a ticking time bomb while juggling flaming torches. However, there is hope in the form of modern technology—machine learning, big data analytics, and secure ID proofing—which offers a timely solution to identify scams and expedite valid claims.

The ERC program, initially designed to offer assistance to struggling businesses in the midst of the COVID-19 pandemic, has rapidly evolved into a colossal endeavor, expanding at an unprecedented rate. According to a report from The Wall Street Journal, the staggering $230 billion that has been disbursed to date is approximately three times the original estimate provided by Congress. And we have another 18 months to go before companies can file for refunds. Regrettably, the current legacy technology and processes may prove inadequate to handle this overwhelming surge, akin to a small-town sheriff suddenly entrusted with managing a bustling metropolis.

The IRS is walking a tightrope. On one end, they must urgently distribute relief funds to desperate businesses. On the other end, they must diligently uncover fraudulent claims that could drain the program's resources. Every day, the IRS performs this risky balancing act, with the stakes higher than ever.Time is of the essence in this high-stakes game. Any delay in approving valid claims not only adds to the burden on the IRS but also triggers their obligation to pay interest, compounding the financial strain. To put it into perspective, a mere 90-day delay on $100 billion in refunds could result in a mind-boggling $1.5 billion in accrued interest, assuming a 6% rate. The urgency to streamline the process and prevent any unnecessary delays is paramount.

The IRS doesn't just deal with numbers; it deals with public perception. While meticulous scrutiny can help deter fraud, it also adds another nail in the coffin for genuine businesses teetering on the brink of bankruptcy. The IRS must delicately navigate this situation, ensuring the trust of both skeptics and desperate believers.

Technology is the Swiss Army Knife that can assist the IRS in this complex landscape. Transitioning to electronic filings for ERC claims is like trading in a horse-drawn cart for a sports car—faster, more efficient, and tailor-made for the challenges of today. By implementing a secure digital ID system, the authenticity of businesses can be verified, preventing individuals like John Doe from fraudulently claiming ERC funds under fake identities or ghost companies. Furthermore, machine learning algorithms can act as intelligent filters, separating the legitimate claims from the suspicious ones, expediting the process.

The silver lining in this high-stakes challenge is the opportunity for substantial technological advancements. These innovations would not only resolve the IRS's current predicament but also establish a precedent for effective and transparent governance. Considering the vast sums involved in the ERC program, the investment in these technological solutions would be a mere fraction, yet their impact could revolutionize the system. The Kobayashi Maru scenario, although daunting, is not insurmountable. It serves as an invitation for the IRS to embrace modern technology innovation, evolve, and emerge stronger than ever before.

Posts by Tag

- big data (41)

- advanced analytics (38)

- business perspective solutions (30)

- predictive analytics (25)

- business insights (24)

- data analytics infrastructure (17)

- analytics (16)

- banking (15)

- fintech (15)

- regulatory compliance (15)

- risk management (15)

- regtech (13)

- machine learning (12)

- quantitative analytics (12)

- BI (11)

- big data visualization presentation (11)

- community banking (11)

- AML (10)

- social media (10)

- AML/BSA (9)

- Big Data Prescriptions (9)

- analytics as a service (9)

- banking regulation (9)

- data scientist (9)

- social media marketing (9)

- Comminity Banks (8)

- financial risk (8)

- innovation (8)

- marketing (8)

- regulation (8)

- Digital ID-Proofing (7)

- data analytics (7)

- money laundering (7)

- AI (6)

- AI led digital banking (6)

- AML/BSA/CTF (6)

- Big Data practicioner (6)

- CIO (6)

- Performance Management (6)

- agile compliance (6)

- banking performance (6)

- digital banking (6)

- visualization (6)

- AML/BSA/CFT (5)

- KYC (5)

- data-as-a-service (5)

- email marketing (5)

- industrial big data (5)

- risk manangement (5)

- self-sovereign identity (5)

- verifiable credential (5)

- Hadoop (4)

- KPI (4)

- MoSoLoCo (4)

- NoSQL (4)

- buying cycle (4)

- identity (4)

- instrumentation (4)

- manatoko (4)

- mathematical models (4)

- sales (4)

- 2015 (3)

- bitcoin (3)

- blockchain (3)

- core banking (3)

- customer analyitcs (3)

- direct marketing (3)

- model validation (3)

- risk managemen (3)

- wearable computing (3)

- zero-knowledge proof (3)

- zkp (3)

- Agile (2)

- Cloud Banking (2)

- FFIEC (2)

- Internet of Things (2)

- IoT (2)

- PPP (2)

- PreReview (2)

- SaaS (2)

- Sales 2.0 (2)

- The Cloud is the Bank (2)

- Wal-Mart (2)

- data sprawl (2)

- digital marketing (2)

- disruptive technologies (2)

- email conversions (2)

- mobile marketing (2)

- new data types (2)

- privacy (2)

- risk (2)

- virtual currency (2)

- 2014 (1)

- 2025 (1)

- 3D printing (1)

- AMLA2020 (1)

- BOI (1)

- DAAS (1)

- Do you Hadoop (1)

- FinCEN_BOI (1)

- Goldman Sachs (1)

- HealthKit (1)

- Joseph Schumpeter (1)

- Manatoko_boir (1)

- NationalPriorites (1)

- PaaS (1)

- Sand Hill IoT 50 (1)

- Spark (1)

- agentic ai (1)

- apple healthcare (1)

- beneficial_owener (1)

- bsa (1)

- cancer immunotherapy (1)

- ccpa (1)

- currency (1)

- erc (1)

- fincen (1)

- fraud (1)

- health app (1)

- healthcare analytics (1)

- modelling (1)

- occam's razor (1)

- outlook (1)

- paycheck protection (1)

- personal computer (1)

- sandbox (1)

Recent Posts

Popular Posts

Here is a funny AI story.

Every community bank CEO now faces unprecedented...

On May 13, 2025, the U.S. government announced...