PPP is Not a Free Lunch for Banks

During the post-prohibition era in the 1930s, bars offered free lunches to their patrons to get them to buy drinks. 40 years later, Milton Friedman famously summed up the study of economics with the quip – “There is no such thing as a free lunch” or TINSTAFL for short. Now, 50 years later bankers and borrowers alike are recalling TINSTAFL in looking at PPP.

The real challenge for banks now is to manage their risk exposure to PPP loans using the principles of safety and soundness that are embedded in their charter. PPP-related borrowing guidelines have rapidly evolved in the last 100 days. However, prudential banking norms have not changed in the last 100 years.

An audit of past stimulus packages, published in April 2020 by the SBA’s Inspector General, revealed that as much as 40% of all loans had inappropriate or unsupported loan approvals. There’s no indication that PPP loans will be any different—and the total amounts involved could be much larger.

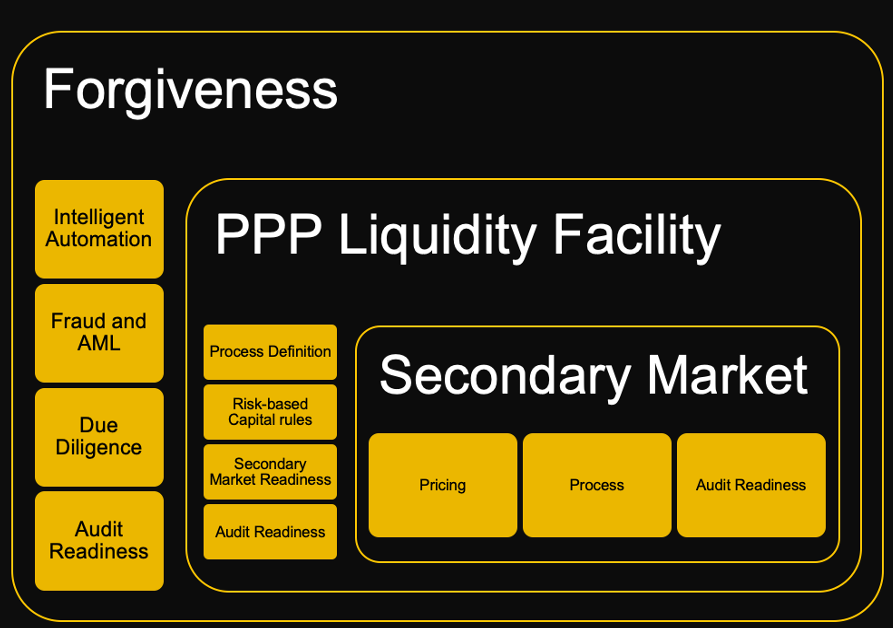

If some PPP loans are considered ineligible for an SBA guarantee, they would also be ineligible for other benefits of the program such as forgiveness and a PPP Liquidity Facility. Loan losses resulting from 5% of these bad loans could potentially wipe out the bank’s origination fee income. While this is an extreme scenario, well-managed banks can be expected to prioritize the identification of bad loans for origination errors to mitigate their risks.

The latest PPP weekly status report from SBA dated May 30, 2020 showed a $1B decline in PPP approved lending. This means that loan cancellation amounts exceeded the loan origination amounts during the week. This indicates that risk mitigation efforts are already under way and will probably pick up in pace in coming weeks.

Taking measure of PPP-related risks is arguably the most important first step to mitigation and management of risk.

PPP-Related Risk

Risk management is a core competency for banks - but PPP loans feature additional and specific challenges.

Operational and Default Risk: Inappropriate or unsupported loan approvals, caused by errors in interpreting guidelines or fraudulent representations by borrowers (potentially including organized crime syndicates). These loans may not be eligible for SBA loan guarantees and will likely have a higher risk of default as borrowers struggle to survive the pandemic induced economic crisis.

Liquidity and Earnings Risk: Borrowers that can’t meet forgiveness conditions will remain on the books at 1% interest. The PPP Liquidity Facility from the Federal Reserve does provide a line of credit at 35 basis points, placing significant pressure on the bank’s net interest margin. But it has to be set up and operational before Sep. 30, 2020 after which the bank will have to use alternate sources of capital.

Capital Risk: Regulators expect to exclude PPP loans from capital risk calculations—but only if they are guaranteed by the SBA and the bank pledges its loans to a PPP Liquidity Facility from the Federal Reserve. Any delays in obtaining the SBA guarantee and setting up the credit line imposes a capital cost on the bank.

SCENARIOS

In the next six months, we expect many updates on PPP loan processing from the SBA, regulators and other federal institutions. These are hard to anticipate, and undoubtedly some will have a material impact on risk. Meanwhile, borrowers are hiring CPA firms to do their forgiveness calculations because they can be more complex than tax calculations. Free solutions like PPP.Bank launched by Mark Cuban and Jill Castilla from Citizens Bank of Edmond are also likely to become popular for borrowers.

The prudent option for banks is to create a robust and resilient approach to manage their PPP-related risk. Here are some scenarios to consider.

- Loan origination calculation errors will surface. Early intervention is the key to modify such loans. Proactive risk management and automation helps flag errors immediately post loan origination, which enables loan officers to cure in a timely manner, so it is eligible for loan forgiveness.

- Forgiveness calculations will be controversial. The stakes are very high which means borrowers will demand explanations if forgiveness amounts are lower than expected. Banks will need to focus their efforts on working with their small business customers.

- Bad actors will attempt to tap into the stimulus package. They will devise new schemes for financial crimes including fraud and money laundering. Detecting them will require forensic analysis and investigation.

AGILE COMPLIANCE AND RISK MANAGEMENT

An agile compliance approach addresses PPP-related risk scenarios. Governance is at the center of the agile compliance approach for risk management. It is based on safety and soundness principles to effectively manage risk.

The traditional approach to systems for risk management entails defining workflow and using software to automate that workflow for rapid execution of tasks. However, these systems need to be constantly updated when rules or guidelines change. These software systems define the business processes and the business processes in turn put limitations on governance. Agile compliance means business processes drive the systems and not the other way around.

The agile process includes forensic analysis of the loan book followed by a risk-based approach to triage cases based on their level of risk. Agile compliance provides an adaptable AI and machine learning based risk management framework which is ideally suited for a program such as the PPP where rules and guidelines are constantly changing well after the program is launched.

DEALING WITH RISK: Measure. Mitigate. Manage.

Effective and efficient management of PPP-related risks is both urgent and important for banks. Banks are expected to address PPP with a rigorous risk management approach that includes risk measurement, risk mitigation and on-going management. This goes beyond simple process automation solutions from software vendors. Banks that implement effective governance, processes and systems will mitigate these risks; those that don’t will have unprecedented risk exposure.

For more information on Amberoon’s PPP-related risk management solution using agile compliance, contact us at venia@amberoon.com.

Posts by Tag

- big data (41)

- advanced analytics (38)

- business perspective solutions (30)

- predictive analytics (25)

- business insights (24)

- data analytics infrastructure (17)

- analytics (16)

- banking (15)

- fintech (15)

- regulatory compliance (15)

- risk management (15)

- regtech (13)

- machine learning (12)

- quantitative analytics (12)

- BI (11)

- big data visualization presentation (11)

- AML (10)

- community banking (10)

- social media (10)

- AML/BSA (9)

- Big Data Prescriptions (9)

- analytics as a service (9)

- banking regulation (9)

- data scientist (9)

- social media marketing (9)

- financial risk (8)

- innovation (8)

- marketing (8)

- regulation (8)

- Comminity Banks (7)

- data analytics (7)

- money laundering (7)

- AI (6)

- AML/BSA/CTF (6)

- Big Data practicioner (6)

- CIO (6)

- Digital ID-Proofing (6)

- Performance Management (6)

- agile compliance (6)

- banking performance (6)

- digital banking (6)

- visualization (6)

- AI led digital banking (5)

- AML/BSA/CFT (5)

- KYC (5)

- data-as-a-service (5)

- email marketing (5)

- industrial big data (5)

- risk manangement (5)

- self-sovereign identity (5)

- verifiable credential (5)

- Hadoop (4)

- KPI (4)

- MoSoLoCo (4)

- NoSQL (4)

- buying cycle (4)

- instrumentation (4)

- mathematical models (4)

- sales (4)

- 2015 (3)

- bitcoin (3)

- blockchain (3)

- core banking (3)

- customer analyitcs (3)

- direct marketing (3)

- identity (3)

- manatoko (3)

- model validation (3)

- wearable computing (3)

- zero-knowledge proof (3)

- zkp (3)

- Agile (2)

- Cloud Banking (2)

- FFIEC (2)

- Internet of Things (2)

- IoT (2)

- PPP (2)

- PreReview (2)

- SaaS (2)

- Sales 2.0 (2)

- The Cloud is the Bank (2)

- Wal-Mart (2)

- data sprawl (2)

- digital marketing (2)

- disruptive technologies (2)

- email conversions (2)

- mobile marketing (2)

- new data types (2)

- privacy (2)

- risk (2)

- risk managemen (2)

- virtual currency (2)

- 2014 (1)

- 2025 (1)

- 3D printing (1)

- AMLA2020 (1)

- BOI (1)

- DAAS (1)

- Do you Hadoop (1)

- FinCEN_BOI (1)

- Goldman Sachs (1)

- HealthKit (1)

- Joseph Schumpeter (1)

- Manatoko_boir (1)

- NationalPriorites (1)

- PaaS (1)

- Sand Hill IoT 50 (1)

- Spark (1)

- apple healthcare (1)

- beneficial_owener (1)

- bsa (1)

- cancer immunotherapy (1)

- ccpa (1)

- currency (1)

- erc (1)

- fincen (1)

- fraud (1)

- health app (1)

- healthcare analytics (1)

- modelling (1)

- occam's razor (1)

- outlook (1)

- paycheck protection (1)

- personal computer (1)

- sandbox (1)

Recent Posts

Popular Posts

Every community bank CEO now faces unprecedented...

On May 13, 2025, the U.S. government announced...

In our continuing exploration of banking...