Understanding Healthcare Provider Use Cases with Analytics

Health expenditures in the United States neared $3.0 trillion in 2013 which is over ten times the $256 billion spent in 1980. Almost 15% of U.S GDP is estimated to be spent on healthcare.

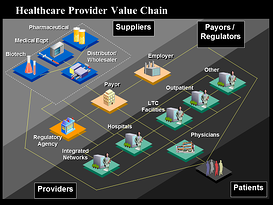

As a mega-vertical, healthcare covers several major segments (the 7 Ps)

As a mega-vertical, healthcare covers several major segments (the 7 Ps)

-

Payers (Health Insurance and Plans)

-

Providers (Hospital Systems, Labs and IDNs)

-

Pharmacy (retail distribution networks), and

-

Pharmaceutical and medical equipment manufacturers,

-

Prescribers (Physicians and clinics)

-

Police (regulators)

-

Patients

The drivers impacting cost of healthcare include:

-

Aging population – 100% are aging

-

Rise in Chronic Disease – 75% of cost

-

Demand for technology continues

-

Drug cost – better, but still bad (Generics exchanged for biological drugs)

-

Waste – estimated at 30%, but depends on definition

The healthcare ecosystem is being reshaped by two powerful counter economic forces at work: (1) Improve quality of care and (2) drive the cost of care down. Basically spend less and get more. As a result, the entire healthcare ecosystem is changing into a “information-driven”, “evidence-based” and “outcome-driven” model.

In this posting we look at Health Care use cases and how analytics is being slowly but sure being adopted under the guise of Health Reform in the form of informatics.

What is driving analytics adoption in healthcare? Lots of data, little information and less knowledge. Also regulatory reform such as Accountable Care Organizations (Pay large health organizations to save money and raise quality through process improvement) are going to accelerate analytics leverage.

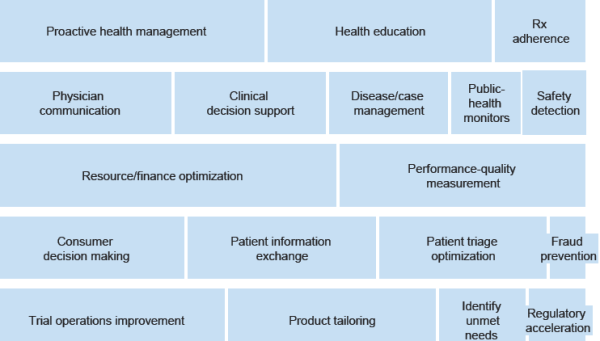

Among the benefits the healthcare system is expected to gain from widespread adoption of analytics tools and processes:

-

Care management solutions that integrate health and wellness

-

Improve decisions about when and how to treat

-

Revenue management best-practice insights within local markets

-

Consumer engagement, health, and management tools

-

Clinical analytics integrated with health management

-

“Pay for Quality” reimbursement change predictability

-

Health management tools integrated with communications technologies, workflows, and analytics

-

Real-time clinical decision support

-

Mining for unknown variables that influence quality…such as “hidden” readmission factors

-

Evidence-Based Medicine, which standardizes clinical processes, protocols, and guidelines

-

Claims data analysis for fraud etc.

Healthcare Provider Maturity

In recent years, many payors (like Cigna, Aetna, Blue Cross Blue Shield, Wellpoint etc.) have shifted from fee-for-service compensation, which rewards physicians for treatment volume, to risk-sharing arrangements that prioritize outcomes. Under the new models, when treatments deliver the desired results, healthcare provider compensation (hospital networks, physicians etc.) may be less than before. Payors are also entering similar agreements with pharmaceutical companies and basing reimbursement on a drug’s ability to improve patient health. In this new environment, health-care stakeholders have greater incentives to compile and exchange information.

In the face of structural re-imbursement changes, Healthcare Provider organizations have economic and regulatory compliance questions that require being fact-based and not just “gut feel”:

-

“How are the physicians performing in relation to costs and quality?”

-

“How many patients are readmitted within 30 days of discharge?”

-

“What are the revenue implications of different reimbursement models?”

-

“How can we identify patients during a stay who are high risk for readmission?”

-

“How can we optimize our performance under a new reimbursement arrangement?”

-

“How can we best treat sub-populations of patients who are at high risk for readmission?”

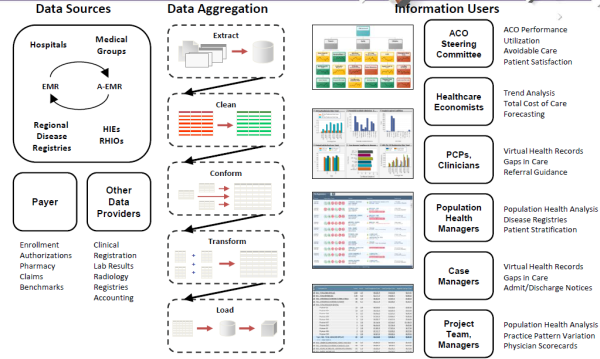

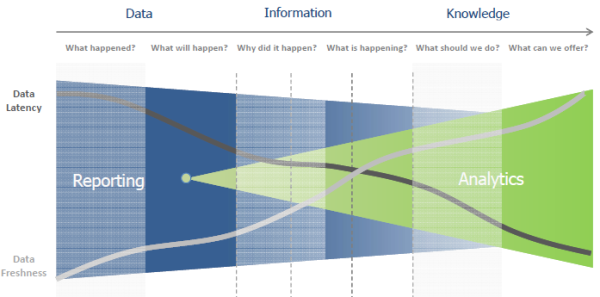

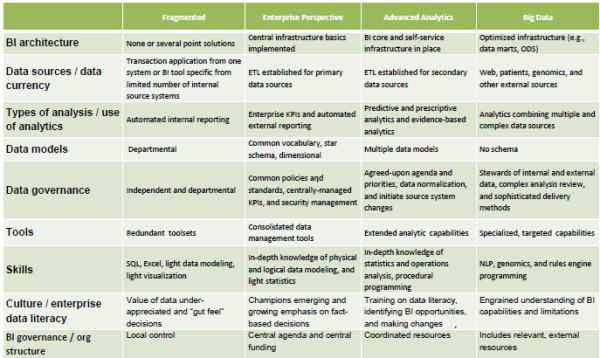

To answer these questions, you need a solid data foundation that is capable of (1) Interrogate the data; (2) discern appropriate action; (3) Drive performance. This foundation typically goes thru 4 stages of execution.

-

Stage 1: Data Collection (Characterized by the expanded adoption of EMRs

-

Stage 2: Data Sharing (Characterized by the expanded adoption of HIEs)

-

Stage 3: Data Analysis (Characterized by the adoption of data warehouses)

-

Stage 4: Data Analytics (Characterized by the adoption of advanced modeling and forecasting techniques)

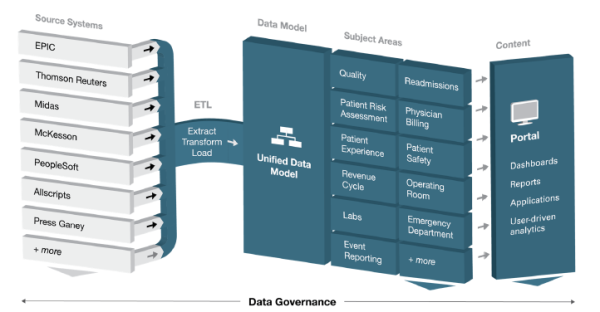

Healthcare BI and Analytics is essentially a set of methodologies, processes, architectures, & technologies that transform raw data into meaningful & useful information used to enable more effective strategic, tactical, & operational insights & decision-making. The end-to-end value chain (data sources, data aggregation to Information users) is shown below (source HIMSS 2013).

Healthcare Providers Use Cases

The end-goal of Healthcare Provider BI and Analytics is almost every situation boils down to 3 value patterns:

-

Support new business models and opportunities

-

Support ongoing business operations

-

Meet compliance requirements

For years, healthcare administrators have used BI and analytics to better run the financial and administrative side of their businesses. The focus has been on workflow‐integrated information which enables healthcare providers to drill from reports into detailed analyses of quality, safety, efficiency, effectiveness, regulatory and financial aspects of care practice to identify poor quality, waste, non‐standard practices, under or over‐utilized services, & opportunities for improvement.

Now, with new sources of digital data about patients and their clinical experiences, and new tools to interpret them, BI and analytics can also be applied across the healthcare continuum. As the provider networks update technology to better manage changes brought about by health reform initiatives, they are beginning to transition from legacy systems that focus on internal data repositories to a more collaborative, outward-facing, patient-centric model that integrates healthcare data from claims, electronic health records (EHRs), personal health records (PHRs), analytics technologies, customer relationship management systems and health insurance exchanges.

Now, with new sources of digital data about patients and their clinical experiences, and new tools to interpret them, BI and analytics can also be applied across the healthcare continuum. As the provider networks update technology to better manage changes brought about by health reform initiatives, they are beginning to transition from legacy systems that focus on internal data repositories to a more collaborative, outward-facing, patient-centric model that integrates healthcare data from claims, electronic health records (EHRs), personal health records (PHRs), analytics technologies, customer relationship management systems and health insurance exchanges.

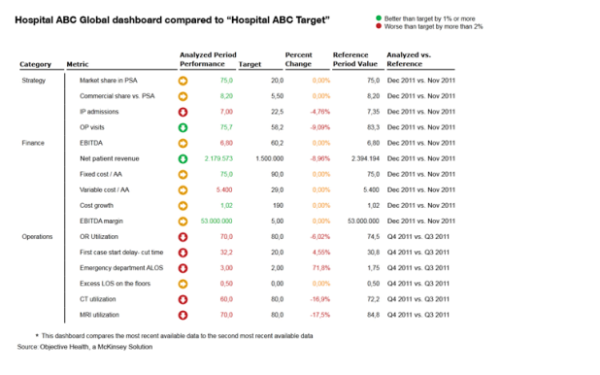

Comparative Benchmarking

The value of this use case is to assist hospitals in measuring both their financial and clinical performance against their peers as well as their past, and provide a picture based more on real-time data than estimations and gut feelings.

Comparative analytics uses standardized data to give organizations an objective and timely performance measurement, against their peers as well as their past.

This data complements an organization’s internal performance management tools that answer the question “Are we improving or degrading our performance?” by answering additional questions of “Is our performance in line with industry leaders?” and “Are there factors beyond our control influencing our performance?”

What are High‐value episodes to reduce the potential for readmittance. .

-

DRG and episode targeting

-

Care models and gainsharing

-

Cost management

-

Readmittance elimination

The government is now penalizing a readmittance in 30-day…the penalty is 5X the cost

With such benchmarks, administrators can develop clinical workflows that are more efficient and productive, and can also measure and manage financial strengths and weaknesses.

Population Analytics use cases

Right information to the right clinician to provide the right care is the objective; Empower caregivers with the right information is the mantra… address questions like:

-

Use Case 1: Is there a way to pull a list of all children with an allergy to a benzodiazepine?

-

Use Case 2: What is the approximate proportion of influenza vaccinated patients in 2011 that were admitted to the hospital due to influenza’s DX in 2012.

A centralized repository provides advantages including economies of scale for the technical infrastructure and enhanced data security. All participant-contributed data are stored in the same physical repository with logically segmented participant data to prevent co-mingling of information. Data are synthesized from incompatible silos on any platform or format. Extract, transform and load processes maintain data quality, so accuracy of research based on data can be trusted. “Virtual” access of disparate data sources is an option, but trades significant future work in these areas for initial savings on integration. Centralization is commonly understood as an Enterprise Data project, but can be performed via analytics services that span enterprises.

Ultimately, EMRs will enable population analyses (High-Risk, High-Cost populations) to inform clinical and financial strategies for health systems and practices, in alignment with the HITECH and Affordable Care Acts.

Patient Insights Use Cases

There is growing demand for use-cases around Patient Insights which examine patient treatment and medication consumption behavior.

These basically leverage Anonymized Patient Longitudinal Data (APLD) to deliver insights into patient treatment and medication consumption behavior over time by diagnosis, for different drugs or within a market . These insights include lifetime value of a patient, source of business, patient trends by diagnoses, compliance & persistency, product utilization across patient types, and length of therapy.

The objective of analytics is to gain an understanding of how the patient is treated within a therapeutic class and/or by disease state as well as the patient and practitioner characteristics associated with certain therapy regimens such as patient age and gender, prescriber specialty, payment type, and procedures.

Health System Modernization and Analytics

Everyone realizes that health reform is badly needed. The U.S spends 15% of GDP on healthcare. The need for change is obvious:

-

People are living longer but not necessarily healthier.

-

Care is more costly and inefficient.

Find better ways to improve cost AND quality? That’s where health reform comes in. Health reform is not any one government or commercial program. It is not an Accountable Care Organization (ACO), ObamaCare, Patient Centered Medical Home (PCMH), Health Home (HH) or Medical Neighborhood (MN).

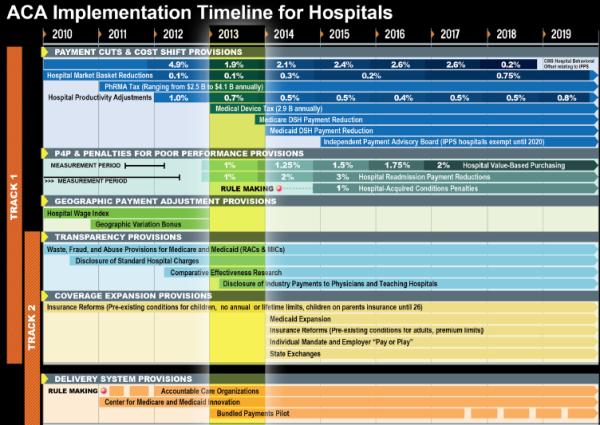

Health reform is all of this and more. Health reform is care delivery reform, payment reform (volume based “fee for service” to outcome-based “fee for value”), clinical outcomes, incentives and preventative programs (wellness), and health and healthcare community reform combined.

-

Care Delivery Reform – Collaborative care models that blend organizational, clinical, financial, and technical interventions. Examples include, but are not limited to, ACO, PCMH, HH, and MN.

-

Payment Reform – Economic change in provider reimbursement. The traditional models of volume-based rewards and who pays for care are being challenged. Payer innovation is happening that includes self-insured providers, employers, public and private insurers, and even patients in new roles.

-

Health and Healthcare Community Reform – Traditionally, healthcare happens at a clinician visit. However, to manage the overall health of a patient and truly affect outcomes, broad community engagement is critical. New types of community and wellness partners are working with clinicians on innovative ways to improve health.

Hospitals networks and payers are really being forced to change. Below is a multi-year time with the major milestones that need to be met (source: HIMSS Conference 2013)

Big Opportunity — Creating a Healthcare Provider Analytics Strategy

The transition from fee-for-service to value-based outcomes is monumental, both in terms of

operational workflow (practice) redesign (ACOs, bundled payments, episodes of care, quality/performance analytics, etc.) but perhaps even more significantly a cultural/philosophical paradigm shift for medicine in the US. The payers are in the driver seat, but the providers/health systems are the key to making it work.

The next ten years in healthcare are going to be about how to get to the target state from current state. Most current state Provider environments have the following characteristics:

• Mix of EMRs

• Lack of data standardization

• Multiple and redundant tools

• Incomplete aggregation

• Limited or no longitudinal data

• Limited access

• Local priorities

• No single source of truth

The journey from AS-IS to TO-BE state is not going to be easy and pain-less. It is going to take a lot of block and tackling that are going to keep the consultant community very busy.

AS-IS to TO-BE Roadmap

Obviously the first step is to get started on building your next phase of the maturity model by doing tactical tasks:

1) Gain a deep understanding of the strategic direction for the next one,

two, and three years to align the analytics plan. Is the strategic direction include: (a) Form an ACO? (b) Add value-based contracting? (c) Pursue quality and cost initiatives?

2) strengthen the foundational architecture, data model, and tool choices based on your planned gameplan – (a) Standalone EDW, bus architecture, or EMR bundled analytics, or (b) Pre-packaged data model for descriptive analytics; (c) Specialized tools for predictive analytics?

3) Get the political buy-in to drive change… engagement with and readiness for the target agenda.. (1) Are key business and clinical execs engaged in leadership roles? (b) Can the silos of federated models be swayed to an enterprise approach? (c) Is the enterprise ready to make hard changes based on the story told by the data?

Summary

Transforming healthcare via IT has been the mantra for 3 decades now. But change has been slow — two steps forward…one step back….. but Healthcare Reform is having an impact:

-

HITECH Act/”Meaningful Use” – Get doctors using computers to measure data more efficiently and improve outcomes.

-

Patient-Centered Medical Home – Focus on patient subsets where intervention will save $

-

Accountable Care Organizations (ACO) – Pay large health organizations to save money and raise quality through process improvement.

Healthcare IT, BI and Analytics is basically the tool for change. It essentially a set of methodologies, processes, architectures, & technologies that transform raw data into meaningful & useful information used to enable more effective strategic, tactical, & operational insights & decision-making.

Data, however, is now available more digitally as technical advances have made it easier to collect/analyze information from multiple sources—a major need in health care, since data for a single patient may come from various payors, hospitals, laboratories, and physician offices. The US federal government, FDA and other public stakeholders have been opening their vast stores of Medicare and Medicaid health-care knowledge, including data from clinical trials and information on patients covered under public insurance programs. In parallel pharmaceutical companies have been aggregating years of research and development data into medical databases, while payors and providers have digitized their patient records (EMR).

In sum, as healthcare becomes a greater portion of expenses for employers, public and private insurers, and even patients, there is an increasing focus on analytics to drive efficiency and value. But transforming this massive system from current status-quo is not going to be easy or a quick-fix. It will take several decades.

Notes and References

1. Big Shifts in Provider Business and Clinical Models driving Healthcare Analytics – Develop procedures, algorithms, protocols, mathematical models, and training programs to improve the healthcare delivery system by mining the vast amount of data available.

2)How much data does a Hospital handle…example from the Children’s Hospital of Philadelphia (From the HIMSS 2013 Conference)

• Epic Clarity Data: ~2.8 Terabytes

• CDW: ~1.2 Terabytes, 15 Gigabytes/Month

• CDW Patients: 2.5 Million

• Encounters: 33 Million

• Procedures: 63 Million

• Medications: 15 Million

• ESSA Patient Encounter Tool: 10 GB (July 2009-Present) – Encounters, Demographics, Hospital Charges, DX, Census, ADT

3) EHRs: Key IT Components

EHR (electronic health records) (Photo credit: Yann Ropars)

-

Identity management

-

Privacy safeguards

-

Rules engines/clinical decision support

-

Feeds from and interfaces with multiple data sources (interoperability)

-

Data storage (analysis, reporting, retrieval)

-

Consumer portal

-

Eligibility System

– Rules Engine

– Data Management

– Web service and batch interfaces to verification data sources

– Linkages to MMIS

– Identity Management

– Privacy Safeguards

-

Master Data Management

-

Data Storage (analysis, reporting, retrieval)

5) Definition of Clinical Informatics from Stanford – Clinical Informatics is the scientific discipline that seeks to enhance human health by implementing novel information technology, computer science and knowledge management methodologies to prevent disease, deliver more efficient and safer patient care, increase the effectiveness of translational research, and improve biomedical knowledge access.

Related articles

-

Great Point Invests $10 Mln in iVantage Health (pehub.com)

-

Intermountain, Deloitte Tool Analyzes Health Outcomes (informationweek.com)

Posts by Tag

- big data (41)

- advanced analytics (36)

- business perspective solutions (30)

- predictive analytics (25)

- business insights (21)

- analytics (16)

- data analytics infrastructure (16)

- regulatory compliance (13)

- fintech (12)

- risk management (12)

- BI (11)

- big data visualization presentation (11)

- machine learning (11)

- quantitative analytics (11)

- regtech (11)

- AML (10)

- social media (10)

- AML/BSA (9)

- Big Data Prescriptions (9)

- analytics as a service (9)

- data scientist (9)

- social media marketing (9)

- banking (8)

- marketing (8)

- banking regulation (7)

- financial risk (7)

- innovation (7)

- money laundering (7)

- Big Data practicioner (6)

- CIO (6)

- community banking (6)

- regulation (6)

- visualization (6)

- AML/BSA/CFT (5)

- AML/BSA/CTF (5)

- KYC (5)

- agile compliance (5)

- data analytics (5)

- data-as-a-service (5)

- email marketing (5)

- industrial big data (5)

- risk manangement (5)

- Hadoop (4)

- MoSoLoCo (4)

- NoSQL (4)

- buying cycle (4)

- instrumentation (4)

- mathematical models (4)

- sales (4)

- 2015 (3)

- AI led digital banking (3)

- Comminity Banks (3)

- Digital ID-Proofing (3)

- bitcoin (3)

- model validation (3)

- wearable computing (3)

- Agile (2)

- FFIEC (2)

- Internet of Things (2)

- IoT (2)

- KPI (2)

- PPP (2)

- Performance Management (2)

- PreReview (2)

- SaaS (2)

- Sales 2.0 (2)

- The Cloud is the Bank (2)

- Wal-Mart (2)

- banking performance (2)

- blockchain (2)

- customer analyitcs (2)

- data sprawl (2)

- digital banking (2)

- digital marketing (2)

- direct marketing (2)

- email conversions (2)

- mobile marketing (2)

- new data types (2)

- risk (2)

- risk managemen (2)

- self-sovereign identity (2)

- virtual currency (2)

- 2014 (1)

- 3D printing (1)

- AI (1)

- Cloud Banking (1)

- DAAS (1)

- Do you Hadoop (1)

- Goldman Sachs (1)

- HealthKit (1)

- Joseph Schumpeter (1)

- NationalPriorites (1)

- PaaS (1)

- Sand Hill IoT 50 (1)

- Spark (1)

- apple healthcare (1)

- bsa (1)

- cancer immunotherapy (1)

- ccpa (1)

- core banking (1)

- currency (1)

- disruptive technologies (1)

- erc (1)

- fraud (1)

- health app (1)

- healthcare analytics (1)

- identity (1)

- manatoko (1)

- modelling (1)

- occam's razor (1)

- paycheck protection (1)

- personal computer (1)

- privacy (1)

- sandbox (1)

- verifiable credential (1)

- zero-knowledge proof (1)

Recent Posts

Popular Posts

In the ever-changing world of global finance,...

The Internal Revenue Service (IRS) is facing a...

In the echoing corridors of Pearson Specter Litt,...